Kids ask great questions, if you’re paying attention. Here are three questions that my 11-year-old asked recently about credit and loans.

What’s the difference between a debit card and a credit card?

One of the earliest conversations to have with kids is the difference between a debit card and a credit card. This is a difficult concept for kids because they often look exactly alike.

A debit card is tied to a checking account (an account at a bank that normally doesn’t earn interest). You can use your debit card to make purchases only up to the amount available in the checking account. If you have $500 in your checking account, you’ll be able to spend up to $500. (Prepaid cards like FamZoo work in a very similar fashion.)

A credit card isn’t tied to a bank account; it’s basically a loan. When you’re approved for a credit card, the credit card company will say you can borrow up to a certain amount of money — this is your credit limit. The amount of credit extended to you is based on your credit history and how likely you are to be able to pay it back. If you check your statement or online account, it will show you the amount of available credit you have left (minus any purchases you’ve made).

The number one rule of credit cards is to not spend more money each month than you have available to pay back.

When you use credit cards correctly (meaning that you pay the full balance on time, every month) you can often earn a lot of extra perks like cash back or points for gift cards, hotels or flights.

What’s the difference between the amount you owe and the amount due?

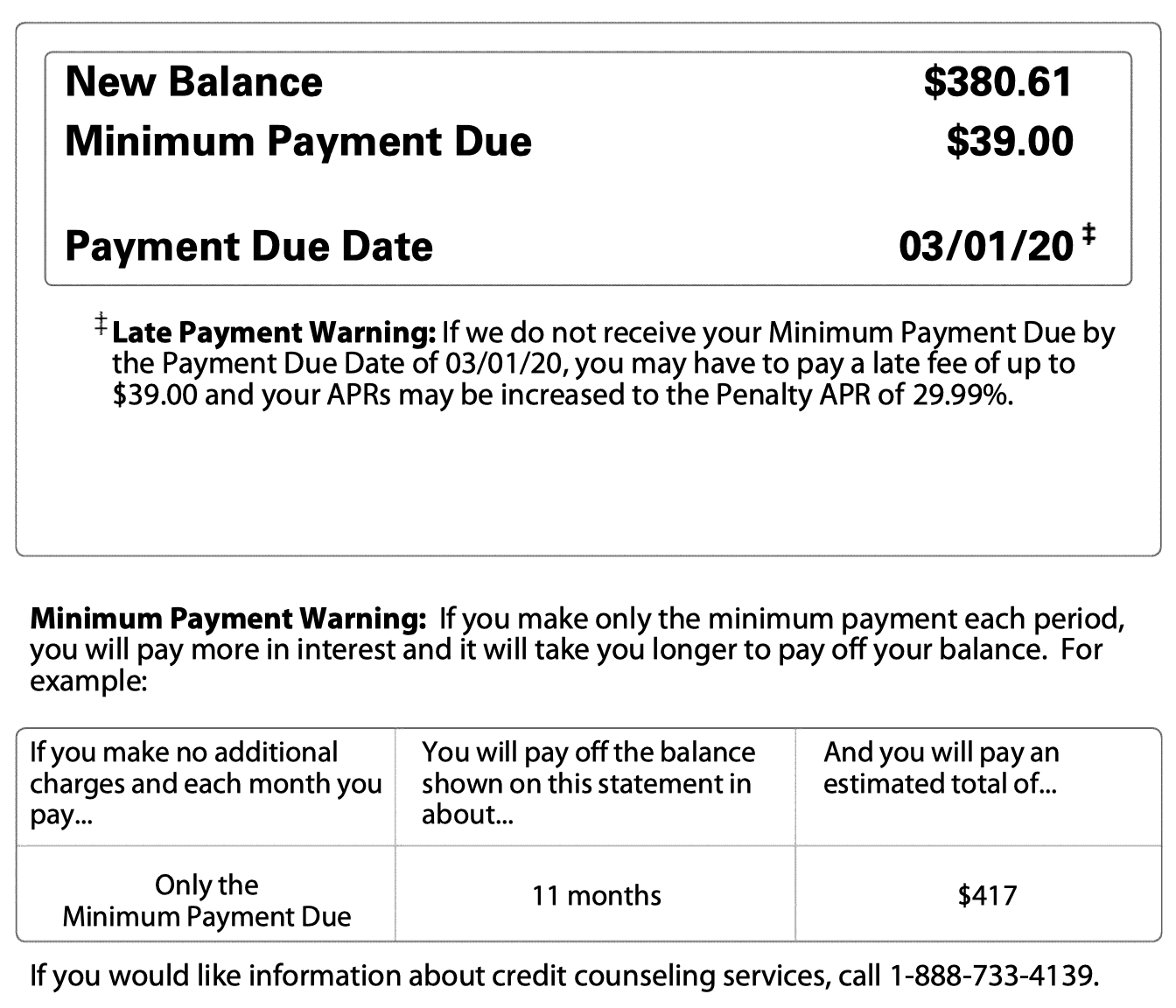

I don’t normally get paper statements, but after I signed up for a new credit card to earn points on flights, the first statement came via snail mail. J saw it on the table and asked, “What’s the difference between the total balance due and the minimum payment due?” In his mind, there’s only one amount due — the total.

The total balance due is the amount of money you owe.

- If you pay the full balance each month, the total balance due is the total of everything you spent (or charged) to the card since your last payment.

- If you don’t pay the full balance each month, the total balance due will include charges to your card AND interest.

The minimum payment due is the very least amount you can pay and not get in trouble!

Some credit card statements (like the one above) have a section that tells you how long it will take you to pay the full amount if you only make the minimum payment each month. Remember, that includes interest owed to the credit card company.

In my example above, if I pay just $39/month on my balance of $380.61, it will take me 11 months to pay it off and I’ll have paid $417 (including $36.39 in interest). And that’s if I don’t charge anything else to the card during that time. If I do, I’ll owe more.

What’s the difference between interest you earn and interest you pay?

I’ve been paying J interest on his savings account since the beginning of our journey. So far, he’s only learned how interest can work for you — your money can make money.

When you save money, you can make money. Just for reference, an online savings account at Ally currently earns 1.60% interest and a CD around 2.00% interest.

When you borrow money, you’re not only borrowing the amount of money you want, you’re agreeing to pay additional money back. A credit card will incur interest if you don’t pay it off each month, but let’s look at two additional examples.

Car loans

You can absolutely save up money ahead of time to buy a car, but many people don’t. When taking out a loan to buy a car, there are a lot of variables:

- Whether the car is new/used

- How old the car is

- Where you’re buying the car from

- The amount of the loan

- Where you live

- How good your credit is

- The term (length) of the loan

Here’s one example of current auto rates from PNC Bank — buying from a dealer, requesting between $15,000 and $50,000 for a car and living in zip code 15222.

That’s a lot of different interest rates. Let’s take just one example — borrowing $15,000 for a two-year old car at 3.64% for 5 years and starting on 3/1/20. (We’d qualify for the lower interest rate if our credit was excellent.)

By entering this information into an online payment calculator, you can see that we’ll pay $16,429.05 for our $15,000 loan — $1,429.05 in interest for the privilege of being able to borrow the money.

Student loans

Going to college is part of the American dream, but how much does it really cost? Likewise there are different options and interest rates based on:

- The amount of the loan

- The term (length) of the loan

- How soon you begin repayment of the loan and if you pay interest during any deferred repayment times

- Your credit score

Below is an example of student loan rates from PNC Bank.

In this example, we’re very well qualified (so we get a lower interest rate) and we’re opting for automatic payments (saving us 0.50%). We’re also only borrowing $10,000 — which in reality might not get us too far depending on where we go to college.

The main differences here are when we want to repay the loan.

- If we start repaying immediately, we’ll pay 4.49% interest. Our monthly payment will be $186.73/month for 5 years and we’ll pay an extra $1,203.72 in interest.

- If we pay only the interest while we’re in school ($39.50/month), we’ll pay 4.74% interest. Our monthly payment when we’re out of school will be $187.52/month for 5 years and we’ll pay an extra $2,850.89 in interest.

- If we don’t pay anything until we’re done with school, we’ll pay 5.24% interest. Our monthly payment will be $228.43 for 5 years and we’ll pay an extra $3,705.74. (Why so much more? Because the interest payment each month while you’re in school is rolled in to the principal, meaning that you’re paying interest on interest. Gah.)

The moral of the story? Paying interest is WAY less cool than earning interest.

What questions are your kids asking? Let me know in the comments below!