A few weeks ago I was talking with a 15-year-old who had just started her first job. She mentioned she wanted to buy a car and opened a savings account to start saving. She had $100 in the account already and the car she was looking at was $3,000.

I started crunching the numbers in my head and coming up with a game plan (because that’s how I roll).

Figure out how much you need

It’s a pretty common wish to have as a teenager, right? To have your own car. But do you know how much cars actually cost?

Time to do some research. Look everywhere from dealerships (new and used, just to compare) to Craigslist.

Take note of the year, make, model, miles on the car, condition of the body, recent inspection, tires and safety features. If you have a friend or relative who is knowledgable about cars, ask for their advice or to go with you when you look at any car in person.

Remember, the cost of the car isn’t the only thing you have to worry about. Sales tax, registration, insurance, gas and maintenance are just a few other expenses that come along with car ownership. Make sure to account for those in your savings goal.

Break it down

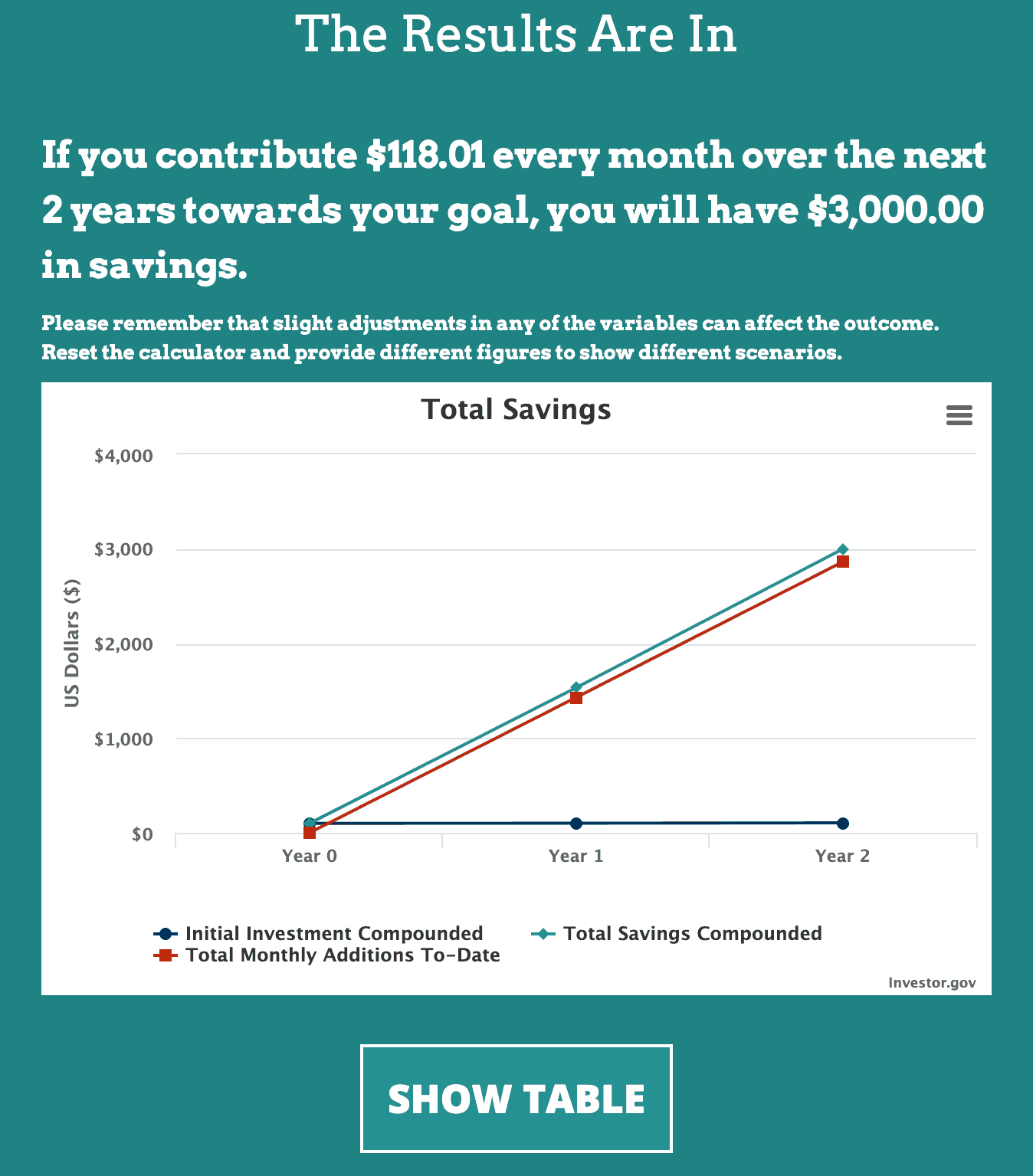

Now that you have a goal in mind, let’s figure out how much you need to save each month using investor.gov’s savings goal calculator.

Enter the savings goal, the starting amount, the length of time to save, the interest rate and when the interest is compounded. (Not sure about the interest rate or compound period? See the next section below.)

In this case, I entered:

- A goal of $3,000

- An initial investment of $100

- 2 years to save (you can also enter partial years as a decimal)

- 2.2% interest

- Compounded daily

To reach the goal of $3,000 in 2 years, the 15-year-old I mentioned would have to save $118.01 every month.

If you have a job, think about if you’re able to save that amount each month based on your paycheck alone AND have enough left over for your other expenses.

It might be a good time to brainstorm other ways to raise additional funds. Here are a few ideas to get you started:

- Tutoring

- Baby, kid or pet sitting

- Dog walking

- Selling stuff you no longer use

- Running errands

- Refereeing sports games

- Painting, landscaping or other handyman (or woman) jobs

Consider asking your family if they would pitch in. They might match some portion of your savings each month if you contribute consistently. (Parents LOVE to see their kids being responsible.)

Open a high-interest savings account at a separate bank

I’ve mentioned our love of Ally bank before. At the time of this post, an online savings account at Ally is earning 2.2% interest. Compare that to what your local bank is offering.

Not only is it great to earn as much interest as possible (read: free money), having the account be separate from your checking account and regular bank makes it harder to access the money. If it’s hard to get to the money, you won’t be able to spend it easily.

Set up direct deposit

If you have a job, you might have access to direct deposit. Ask your employer if they can split your check between checking and savings. Making saving automatic is so important and one of the major keys to success — out of sight, out of mind.

Monitor your progress

You have a goal, a timeframe, income and an automatic savings plan. There’s one last step that will help you stay motivated — monitoring your progress.

Use a simple spreadsheet or visual (think coloring sheets) on the wall where you can see it every day. Watching your money grow will keep you focused, excited and engaged in the saving process.

Following these five steps will put you well on your way to being able to buy your own car. Have questions? Leave a comment below!