The other day my son’s karate teacher told a story about a graduation present she received from her grandmother — a photo album filled with $20 bills.

The grandmother had started saving when her granddaughter was born — adding a $20 bill each month until the 200-page photo album was filled. (It would take 17 years and 2 months to fill it and the album would contain $4,000.)

She’s not the only one who has received a gift like this — check out this woman’s story.

There’s no denying that a photo album filled with cash is an extremely thoughtful gift. There’s also a big WOW factor — who wouldn’t want to receive $4,000 in cash?

I think this gift misses the mark in three important ways, though.

The money isn’t earning interest

The number 1, all important way this gift misses the mark is that the money isn’t earning any interest. Saving for college is important, but if you aren’t earning interest, you’re doing it wrong.

One of the best lessons we can teach our kids is the power of compound interest — that money can make more money. Luckily there are TONS of ways to earn interest:

- Savings accounts (at a local bank, credit union or online bank)

- Bonds (although you should check the rates first)

- CDs

- Stocks

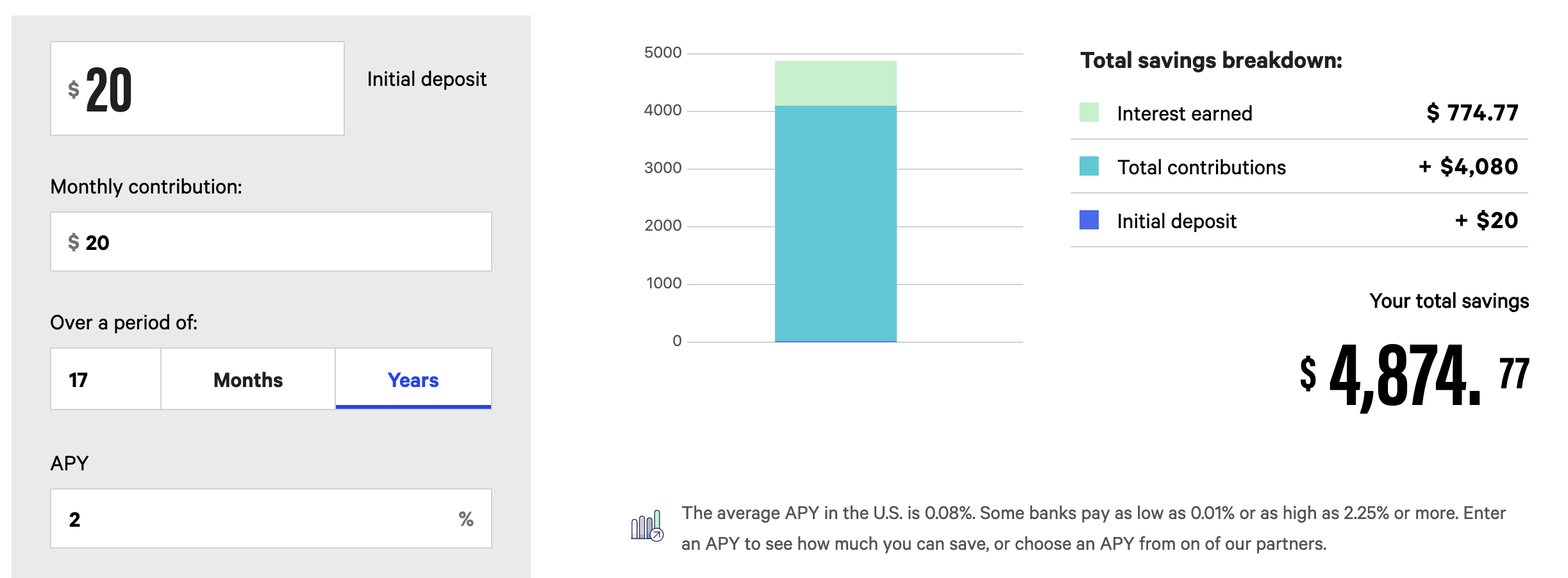

Let’s say you opened an account earning just 2% interest. Starting with $20 and contributing $20 each month for 17 years would give you an extra $774.77 for a total of $4,874.77.

At 3% interest, you’d have an extra $1,227.27 for a total of $5,327.27. That’s a lot of extra money, all for just opening an account.

Communication is key

The best way for kids to learn about money is to talk to them about it. Saving up for 17+ years is a great surprise, but imagine what a great gift a financial education could have been. You — an important person in their life — teaching them to fish instead of giving them a photo album filled with fish.

Wondering what to talk about? Here are a few ideas.

- Take a monthly or quarterly trip to the bank to deposit that money

- Track the growing balance with a coloring sheet or a spreadsheet (or both)

- Read books about money written for kids (like How to Turn $100 into $1,000,000)

Ask questions and encourage them to ask questions, too. See what great conversations happen.

Incentivize participation with matching funds

A great way to get kids interested in saving themselves is to match funds. What if — starting when they were 10 — they pitched in $5/month and you would match an additional $5/month?

Here’s how it could work.

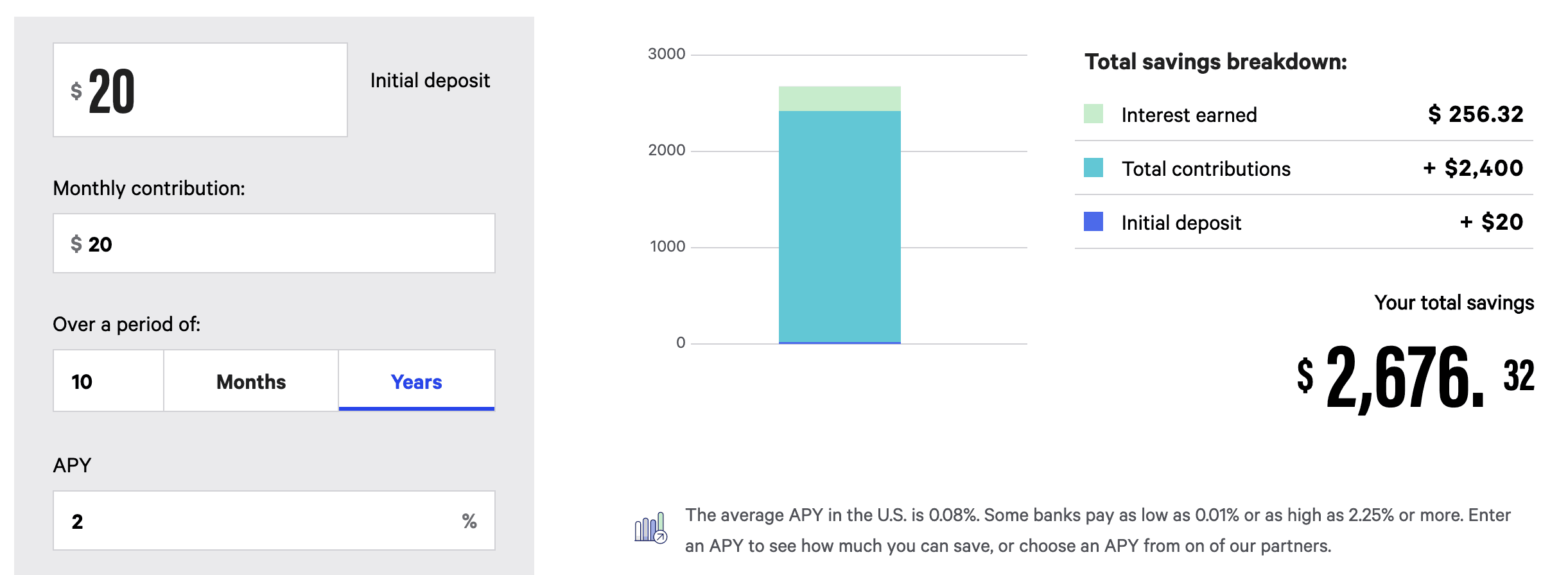

For the first 10 years, you contribute $20/month at 2% interest. At the end, you’d have $2,676.32.

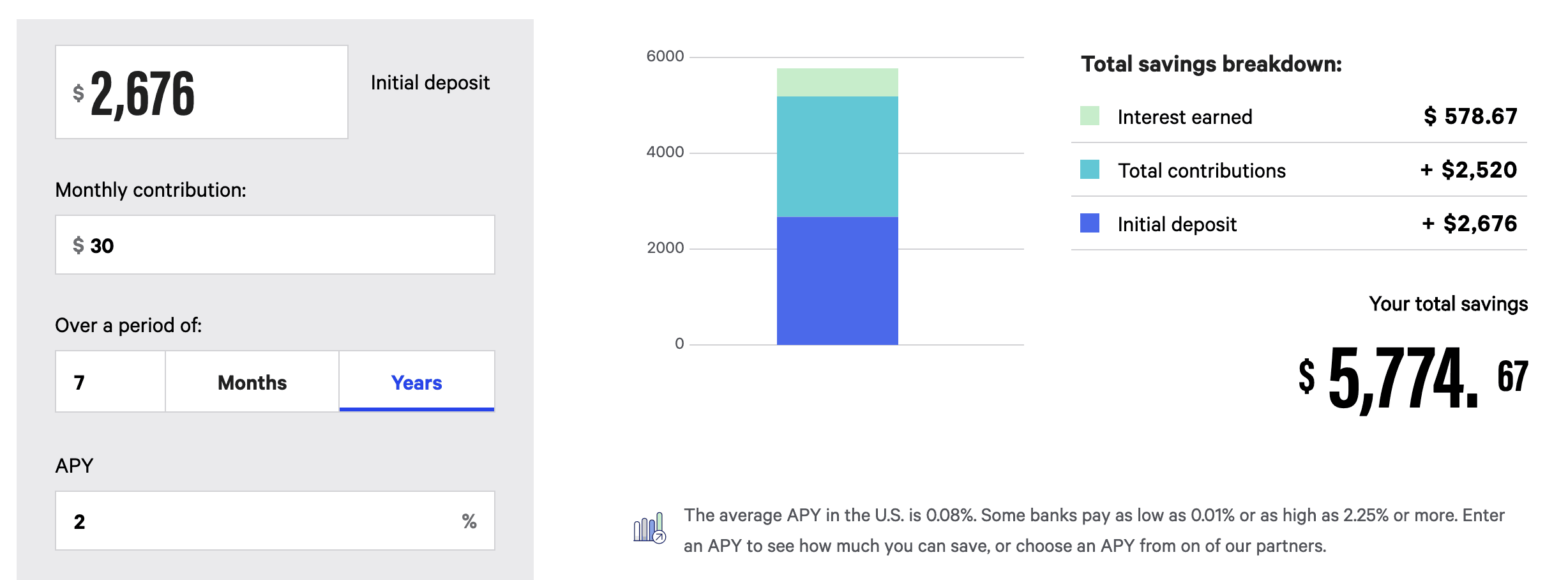

For the next 7 years, the contribution is $30/month — the original $20 + an extra $5 from the child (now that they’re old enough) + an extra $5 from you. At the end, you’d have $5,774.67.

With a bit more effort, you’ve taken a great gift (cash for college) and turned it into a financial education. You’ve taught your loved one how interest works, had great financial conversations with them along the way and encouraged them to participate in saving for their education. THIS is an awesome gift.