I don’t know about you, but the past few months have been really hectic. We’ve been busy with work, school, activities and holidays.

Sometimes when you’re so frazzled, it seems like it will never end. But January is upon us — a chance to start fresh, scale back and go into the new year feeling more calm.

I’ve been circling around the idea of a no-spend month for a few weeks. A no-spend month is a month (or any amount of time) where you don’t spend any money outside of necessities. You still pay your rent or mortgage, car payments, debt payments, utilities, etc. but you cut out the discretionary spending.

When I first mentioned this to J, he was a little confused — a no-spend month where you actually DID spend money didn’t make a lot of sense. (Kids can be very literal.)

I explained that there’s almost no way to not spend ANY money for a month (aside of pre-paying everything I guess, which may be difficult to do), but that the sentiment was really to cut back on all the extra STUFF, which in my mind leads to more stress.

Stuff takes up a lot of our time and mental energy:

- Researching the thing to buy

- Earning, finding and spending the money

- Balancing your accounts (if you do that)

- Getting the thing to your house (if you pick it up)

- Finding a place for the thing in your house

- Using the thing (or feeling guilty for NOT using the thing)

- Storing the thing

- Cleaning the thing (or cleaning around it)

- Eventually getting rid of the thing

So our no-spend month is really a “no extra stuff month” and I’m hoping it will lead to a calmer January.

Rules for our no-spend month

These are the rules I set for our no-spend month.

Allowed

- Utilities, rent, insurance and other necessities

- Pre-existing monthly obligations (karate, braces, subscriptions, our monthly haircuts)

- Groceries

- Gas for the car

Not allowed

- Amazon purchases

- Eating out/takeout

- Clothes

- Movies, rentals, books or excursions that cost money

- Shiny objects of any kind (including business expenses — I’m talking to you AppSumo)

Additional notes

In addition, I will:

- Prepare meals from the fridge, freezer and pantry first

- Always shop with a list (and make sure the list contains necessities and not “nice to haves”)

- Pay special attention to the household goods category (this is where I can see myself buying extra and saying we need it)

- Use store pickup when possible

- Review our subscriptions to see if they’re all still being used

If you’re doing your own no-spend challenge, set rules that work for you and your family.

What we can do instead

Even though I listed several things that we can’t do, there are tons of things we can do instead.

- Get outside — take a walk around town or go for a hike

- Finish outstanding projects (I often have some sort of photo or home project that’s half completed)

- Clean, tidy or reorganize

- Read books that we already have

- Watch movies we already own

- Play games

- Listen to music

- Bake, cook or meal prep

- Reach out to friends and family — send cards, call or visit

I’m sure there are more ideas, too! Comment below if you have any additional ideas for us.

Results

Here’s how we did!

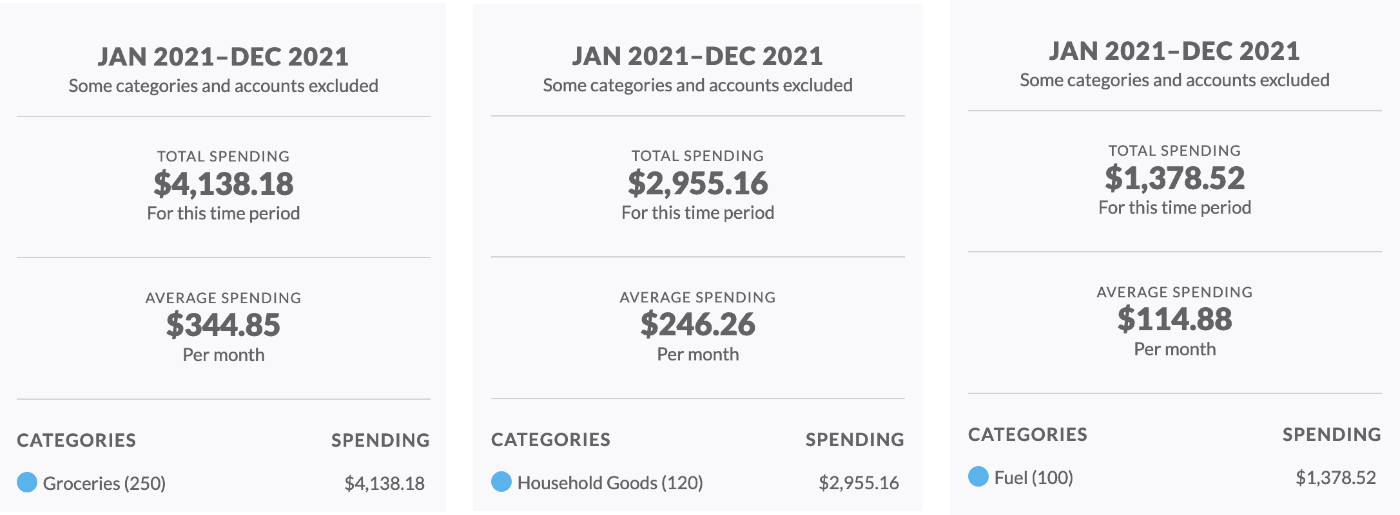

Allowed

Even with preparing meals from the fridge and pantry first, I spent $314.92 in groceries. This was surprising to me because I start with a budget of $250/month for groceries and hadn’t realized that the price of food has gone up since I set that budget up forever ago. I checked YNAB and see that my average grocery spend for 2021 was $344.85 per month!

The same goes for household goods and gas for the car. My household goods budget is $120 (I spent $123.75 in January) but my 2021 average was $246.26. My fuel budget is $100 (I spent $100.17 in January) but my 2021 average was $114.88. I will take a look at the budget numbers and adjust for the future.

I did use Target curbside pickup once and went into the store once. I almost always shopped with a list as well, although later in the month I did shop once or twice without one.

Not allowed

I didn’t make any Amazon purchases in January and didn’t even browse, although I added two books to my wish list.

Not eating out was okay except after awhile I was dying to eat out! My partner bought us slices of pizza one Saturday when we were out near his favorite pizza place, and J bought us DQ blizzards (because we were worried that the candy cane chill blizzard would be leaving soon and we wanted to catch it before it did). I’ve eaten out twice since the challenge ended, and it hasn’t been as satisfying as I wanted.

I didn’t buy any clothes during the month and we didn’t buy any books, etc. — just used and watched what we already had.

I did have a few business expenses in January (no AppSumo purchases though!):

- A new router/modem for $278.91. My partner called to get me a better deal on internet service and with a lower price came an increase in speed, so I needed a new router/modem to take advantage of the higher speed.

- New software for the websites I manage. I had been paying around $80/month to manage about 50 websites, so I switched to a different piece of software with a one-time cost of $399. I also gave a gift to a colleague who answered a lot of questions for me about the new software.

I did have some additional spending that fell outside of the challenge:

- Donation to two charities ($134.02)

- Flowers for myself ($13)

- Tickets to a show (for my partner’s birthday) ($79)

- Fabric and elastic to make masks for Valentine’s Day gifts ($32.17)

What we did instead

Instead of spending money, we spent some time outside, made pizza at home, put together a puzzle, went to the gym, hit the Diamond league in Duolingo, did some sewing, cooked, listened to podcasts, read and watched movies.

Final thoughts

In all, I’m really happy I did the challenge and would definitely do it again. I was surprised to not have more to show from it at the end of the month, but after checking, I realized a big initial chunk went towards J’s new braces.

It was REALLY nice to have such low credit card bills each week (I charge everything possible for the points and pay it off weekly). Also nice was not having that many transactions to categorize and sort through.

J was very interested and supportive during the month. He made sure we stayed on track and was happy to participate in the challenge.

Resources

I’m not the first to write about a no-spend challenge. If you’re looking for more inspiration, check out the following:

- Life with Less Mess – No Spend Challenge

- Debt Free Dana – No Spend January Rules

- Simplistically Living – How to Do a No Spend January Challenge

- Make Life Marvelous – No Spend January

- Practical Frugality – No Spend January

- Joe Casabona – No Spend January: An Experiment in Minimalism

- r/simpleliving or r/nobuy on Reddit (and their related communities)

Have you done a no-spend challenge? How did it go? Comment below and share your experience!

2023 Update

We enjoyed the challenge so much last year that we did it again this year! I LOVE having less to reconcile, lower weekly credit card bills and plenty of extra wiggle room.

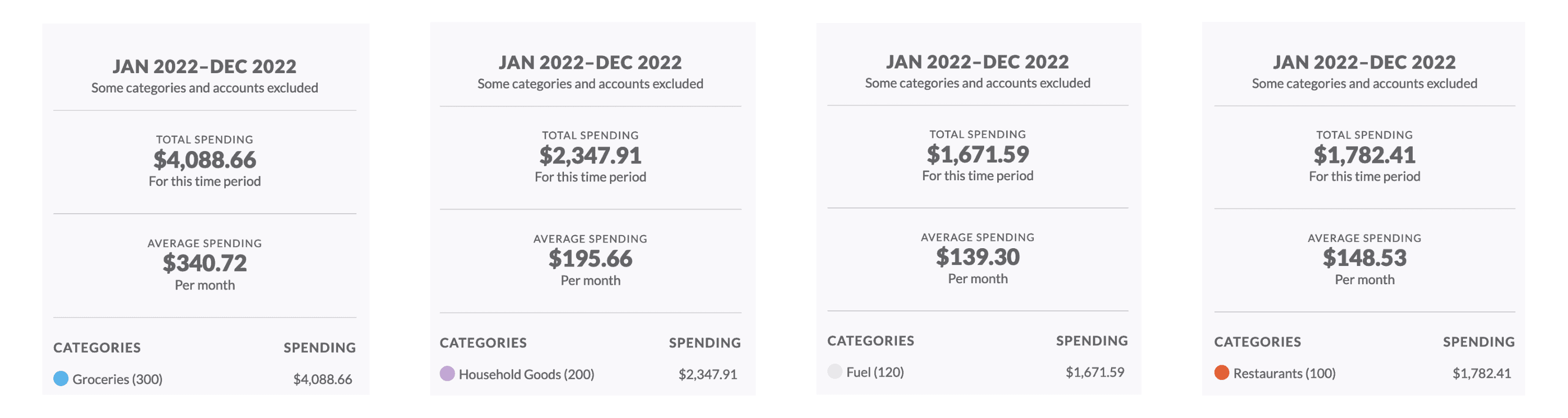

I was also really surprised that groceries were on par with last year and household good spending was less. Fuel was about $25 more per month. And I hadn’t shown 2021 restaurant spending but thought I’d add it here in case I update this post again in the future.

2024 Update

I look forward to doing this challenge every January now! I also really enjoy looking at numbers year over year, which is easy to do in YNAB (although their reporting interface has changed since my previous updates).

2025 Update

I’m gearing up for another no-spend January! Here’s what I spent in 2024 in the four main categories I’ve been tracking — groceries, household goods, fuel and restaurants. Everything is down or on par, except for fuel and that could be because J has his permit!

I want to dig a bit deeper into why it feels like my money doesn’t go as far as it used to.

Health Insurance

My initial suspicion is that it’s partly due to health insurance. Here are my monthly costs since 2019:

- 2019 – $265.79, 2020 – $254.23, 2021 – $238.90, 2022 – $243.67, 2023 – $268.21

- 2024 – $354.66 – Switched to a lower deductible ($2,500/year); previously my deductible was much higher

- 2025 – $391.06

So from 2019 to 2025, an increase of $125.27/month.

Activities

But I think health care costs are only part of the reason. Looking at J’s activities, I’m seeing new costs:

- The trap team: Spring 2023 – $60, Fall 2023 – $126, Spring 2024 – $165, Fall 2024 – $166 (my costs only; these are split with his dad)

- Fees for summer school so he could take classes ahead of time and have more room in his schedule during the year

- Fees for college in high school credits and AP tests

- Musical, choir and of course, band

Subscriptions

I cancelled some subscriptions that I’m no longer using, and my partner and I share the following:

- Amazon/Prime – $139

- Apple TV – $104.94

- Celebrations Passport – $21.19

- Sam’s Club – $110

- Credit card annual fee – $95 (we will switch to no fee card in 2025)

- Hulu/Disney+ – $21.39/month

- YouTube Premium – $24.60/month

J also is using two apps (Flat Music Score Editor for $31.79/year and Focus Hero for $74.19/year) that we’ll evaluate when they come up for renewal.

Gifts

This is an area that feels a little bit out of control. 😆

I’ve spent a LOT on gifts over the past few years — expected gifts for family and friends (birthdays, holidays, weddings, births) — but also on new categories like J’s friends’ graduation parties and gifts to those whose loved ones have passed away.

Car

I bought a 2007 Toyota RAV4 in 2011 with 57,000 miles for $17,000 and have been driving it ever since! Now that J has his permit, I’d like to give him the Toyota and get a new-to-me car.

My dad was a mechanic, so I never really had to worry about maintenance or repairs. Since he passed away in 2020, I’ve had to find a find a garage, get AAA and figure a lot of things out (thanks to help from my partner, who most recently came to our aid when the muffler fell off).

Here are my costs for the last 5 years for maintenance and repairs: 2020 – $948.11 ($79/month), 2021 – $2,313.37 ($193/month), 2022 – $1,534.91 ($128/month), 2023 – $3,907.68 ($326/month), 2024 – $1,865.11 ($155/month).

It was touch and go in 2023 when the car needed significant rust repair work to pass inspection. I wasn’t sure I was going to keep it, but I found a place that did the repairs for a reasonable amount (although still expensive, not as expensive as the dealership).

We’ll see how it goes, but hopefully when I add J to my car insurance policy, the premium won’t be too much as we’ll switch to liability only.

Thoughts

So maybe it doesn’t feel like my money goes as far as it used to because A) I have more expenses (as seen above) and B) (which I haven’t yet addressed here) because I haven’t had a raise since October of 2022. I’m self-employed and the past two years have been tough. I started down the path of specializing my business, and although I poured a TON of energy, time and money into it, the venture did not work out. This year I’ll be switching my focus back to my original web development roots and trying to find some additional clients.

Final Results

I again feel a sense of calm at the end of January because my budget and accounts aren’t all over the place! Here’s what happened this month:

- We did go out four times (I know it sounds like a lot 🤪) — to DQ (but I used points I never actually use), trivia night with a friend, to a Mexican restaurant after a busy evening, and for a pastry after a trip to the emergency vet. It was actually great to get out of the house, and since these were more intentional, I don’t mind having done them. Typically we go out to eat just due to laziness.

- My partner and I went to a museum because an exhibit we’ve been wanting to see was closing. That was $58 split between us.

- We booked our summer vacation plans! Last year we made a mistake and had to get different plane tickets, so we each had credits that had to be used by February. The overage was $385.20 for 3 of us, split two ways. We also booked our hotel for 6 nights using points we’ve built up on our credit card!

- And for J:

- $12 in clothes. We’re looking for a specific kind of suit for the upcoming musical, so I was at a thrift store and could not pass up two really nice sweater vests for $3.50 and a nice sweater/sweatshirt for $7.50.

- Two Amazon purchases — one trombone stand for the new professional trombone J is renting and one computer mouse because the other broke. I used a gift card for both purchases.

- We signed up for the SATs in June.

No-spend January isn’t about being totally perfect, it’s about being intentional. Here’s hoping that I can keep the calm going into February! 😍

2 replies on “Jumping into the new year with a no-spend (no-stuff) challenge”

Oh Maggie, I am HONORED to be included here in your list of resources! I loved your post, including your recent update, you did fantastic! It’s really hard with the way groceries and gas have went up so much. It is a little surprising that groceries were on par with last year, but then again, I think we’ve been dealing with this crazy inflation for awhile now. Yikes!

I didn’t do a no-spend this year, but I think I’d like to sometime in the coming months! I have actively been trying to spend less on things I don’t really need though.

I hope you have a fantastic weekend! 🙂

-Ashley

Yay! Thanks for sharing such a great post that I could link to!