When I first started teaching J about money, we used cash and envelopes. After a few years, we switched to FamZoo’s prepaid cards and last year when he turned 13, we opened regular checking and savings accounts at our credit union.

J has also been using YNAB for two years now, but I wanted to give an update on the entire process and how easy it can be for your teenager to manage their money.

Checking + Savings Accounts

I think 13 is a great age to start with their own checking and savings accounts. Check your bank to determine the minimum age for regular accounts. It’s easiest if you bank at the same place, but you could also open an account at another bank if needed. Some banks like Chase have accounts for teenagers.

We filled out all of the paperwork online and J received a debit card and checks. We added the debit card to his Apple Wallet so he can use the account even if he doesn’t have the debit card with him. We also turned on alerts, so he gets a text after every purchase.

I still pay J an allowance and have scheduled transactions on the 1st of the month that go from my checking to his checking and savings accounts. He chooses what percentage goes to each account — right now he has 30% going to checking and 70% going to savings.

YNAB

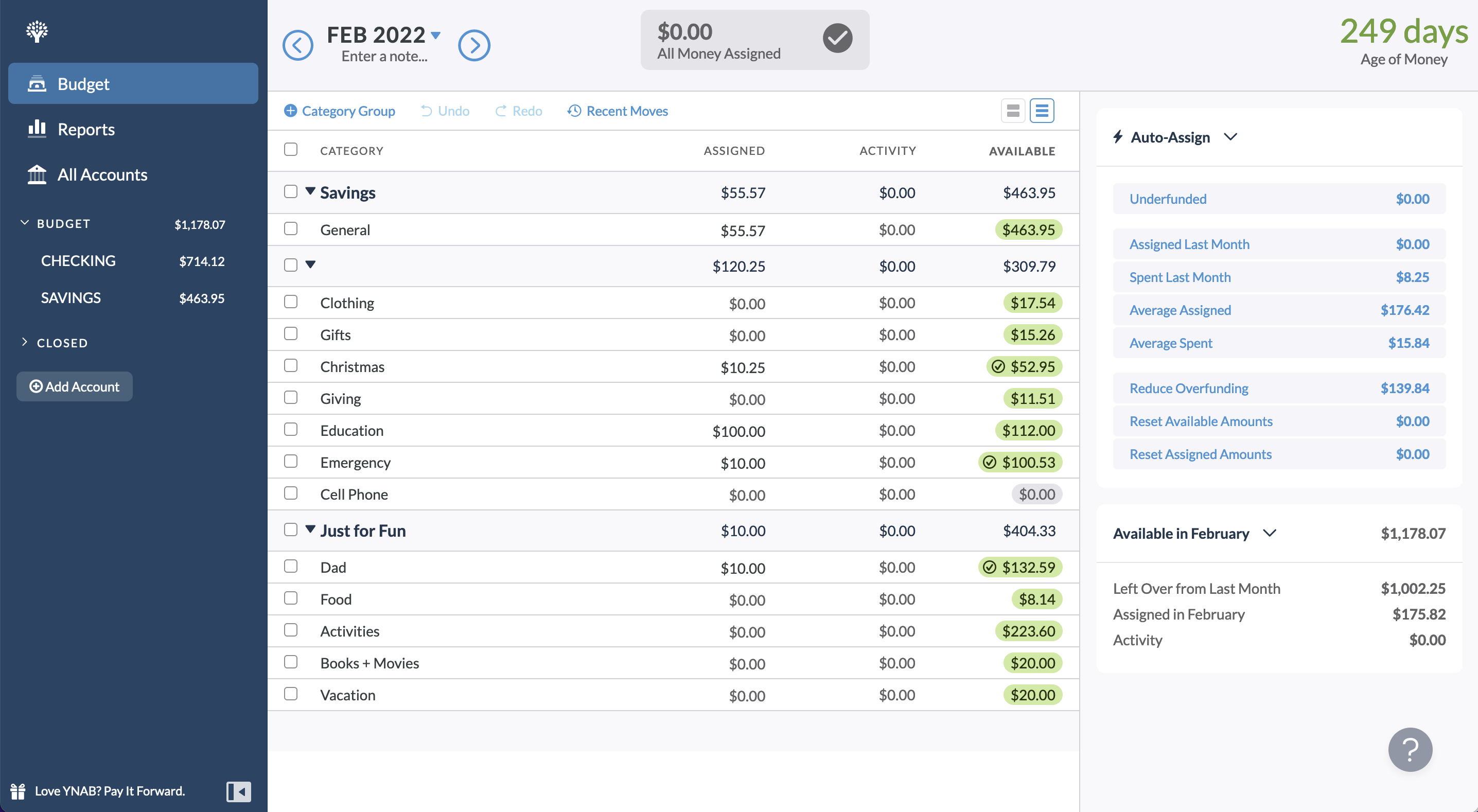

We added both accounts to a new YNAB budget under my account. I actually have several budgets in my YNAB account — my personal budget, my business budget, J’s budget and a budget that I share with my partner.

J’s categories are clothing, gifts, Christmas, giving, education, emergency, cell phone, Dad, food, activities, books/movies and vacation. These have changed slightly over time, but categories are easy to add/remove.

We connected his checking and savings accounts to YNAB so that all transactions show up in YNAB automatically — he just has to categorize and approve them.

Purchases

The process is super simple:

- He makes a purchase

- The transaction shows up automatically in YNAB

- He chooses what category (or categories) it applies to *

- He approves the transaction

- He can see how much is left in that category (or categories)

* If it’s the same payee, YNAB will remember the category, saving more time in the future.

Deposits

Deposits are also simple:

- He makes a deposit (using the bank app on his phone, or if I transfer money to him, in the case of his allowance)

- He approves the amount

- He assigns the money to various categories

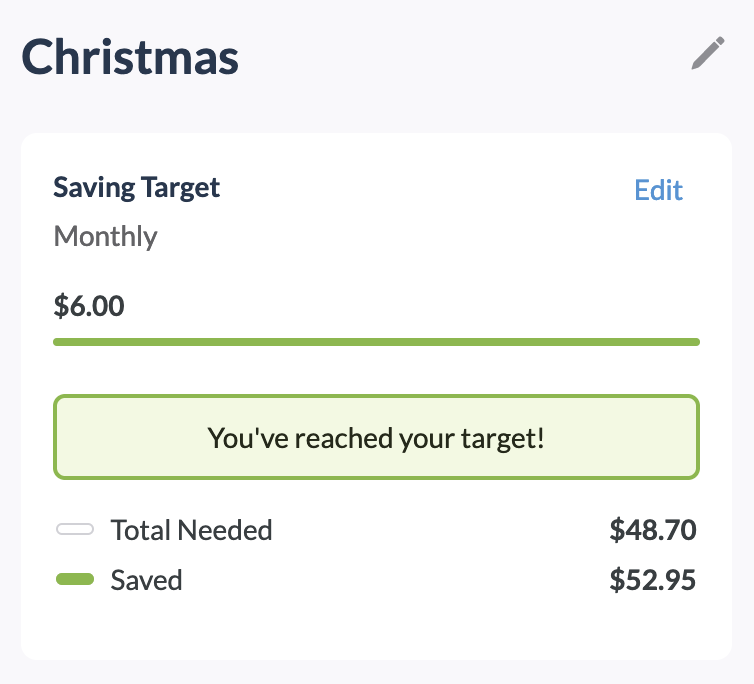

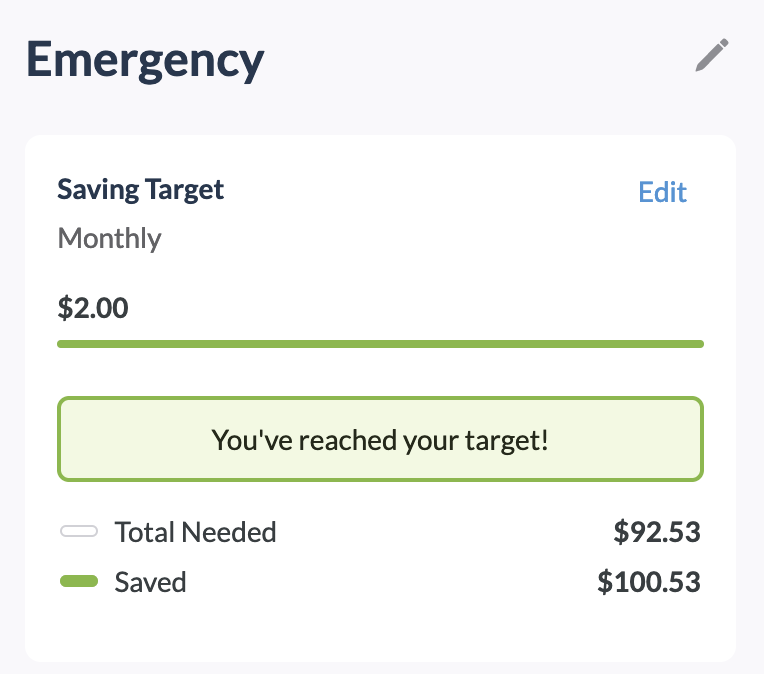

Some categories, like Christmas gifts or other yearly expenses, have targets assigned to them so that he knows how much he needs to add to the category each month.

Simple System

And that’s it. Two accounts and one YNAB budget. We actually don’t even use paper anymore — everything happens on the phone, which is something he always has with him. (We do still keep track of his net worth though using a Google sheet.)

Additional Thoughts on YNAB

What I have above is all that’s needed for a teenager to manage their money, but I have a few additional thoughts to share before I go.

There are two additional features beyond approving a new item in YNAB — clearing the transaction (meaning you can see it at your bank and it’s correct between the two systems) and reconciling the account (which is good to do once in awhile to have a point in time to go back to where you know everything was correct between YNAB and your bank).

As I mentioned, we’ve both added and removed categories over time. As our priorities change, we can also change the amount we assign to each category. Even within the same month, we can move money around to fund categories as needed.

Some people do zero-based budgeting, meaning that any money left in any category at the end of the month is swept — to a savings account for example, but I like to keep money in the categories for future months.

Credit cards also have a slightly different process, and after J has been in high school for a year or two, we will open one for him so I can teach him about credit cards (and points!).

Why YNAB at all?

So why this? Why not just have the checking and savings accounts? For a number of reasons!

- YNAB works with actual money not expected money. Any time you have income, you categorize it. Many “how to budget” articles start by asking how much you expect to have in income this month, which is abstract (and can change). Working with real money makes the process way easier to understand.

- Being able to see smaller buckets rather than the whole is crucial. Seeing the whole account balance at once can make you feel like you have a TON of money, but when you see individual buckets you can make better decisions. (Both this and the previous thought are Profit First concepts as well.)

- You can categorize purchases more effectively — that $200 Target run is a big unknown, but $75 in groceries, $75 in household goods and $50 in gifts is easier to understand.

- You can better save for yearly items like Christmas and insurance each month. Paying yearly for insurance is cheaper, too.

- You can see past spending appropriately. I know exactly how much I spent eating out last year, so…

- I can make changes (if I want to) based on actual data. If I’m unhappy with how much I spent on eating out, I can measure my progress based on the before and after numbers.

- If you don’t do zero-based budgeting, you always have some extra in the account just in case. If I go over my grocery budget, I know that I’m not going to get hit with an overdraft fee because I have Christmas money hanging out there.

Do you have a different process for your teenager? I’d love to hear in the comments below!