There’s a great personal finance book by Helaine Olen and Harold Pollack — The Index Card: Why Personal Finance Doesn’t Have to Be Complicated. The idea is that “everything you need to know about managing your money could fit on an index card.”

Olen and Pollack aren’t the only ones who have created an index card full of money advice. Bill from FamZoo has one — The 5 Things I Want To Teach My Kids About Money Fit on a 4×6 Index Card. I also love these slide shows from the New York Times — one and another.

Reading all of the different ideas and loving the simplicity of the project, I decided that it was time to create my own.

In my case, it turned out to be three cards:

- Four things I want to teach my son (it’s a bit philosophical)

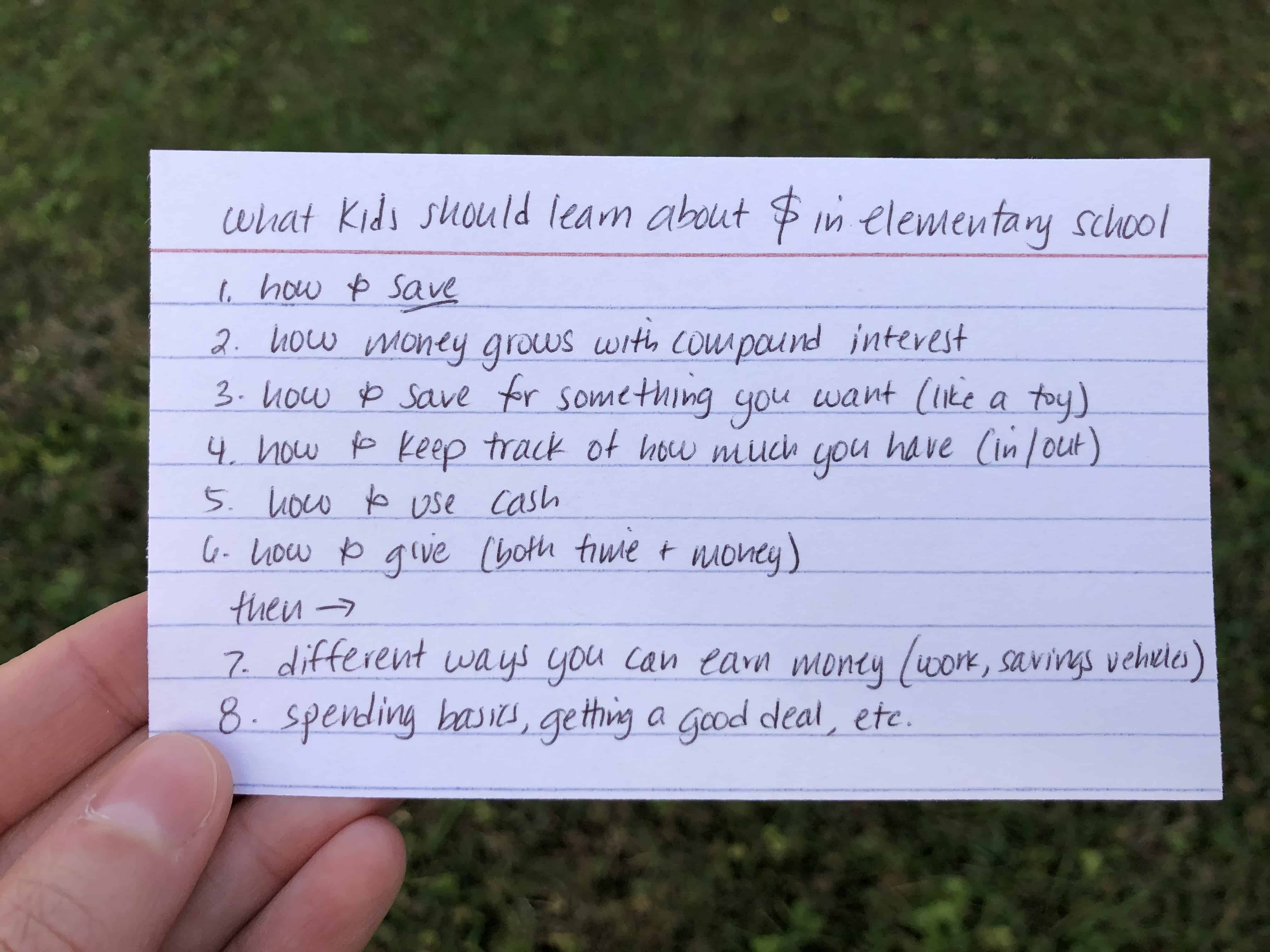

- What kids should learn about money while they’re in elementary school

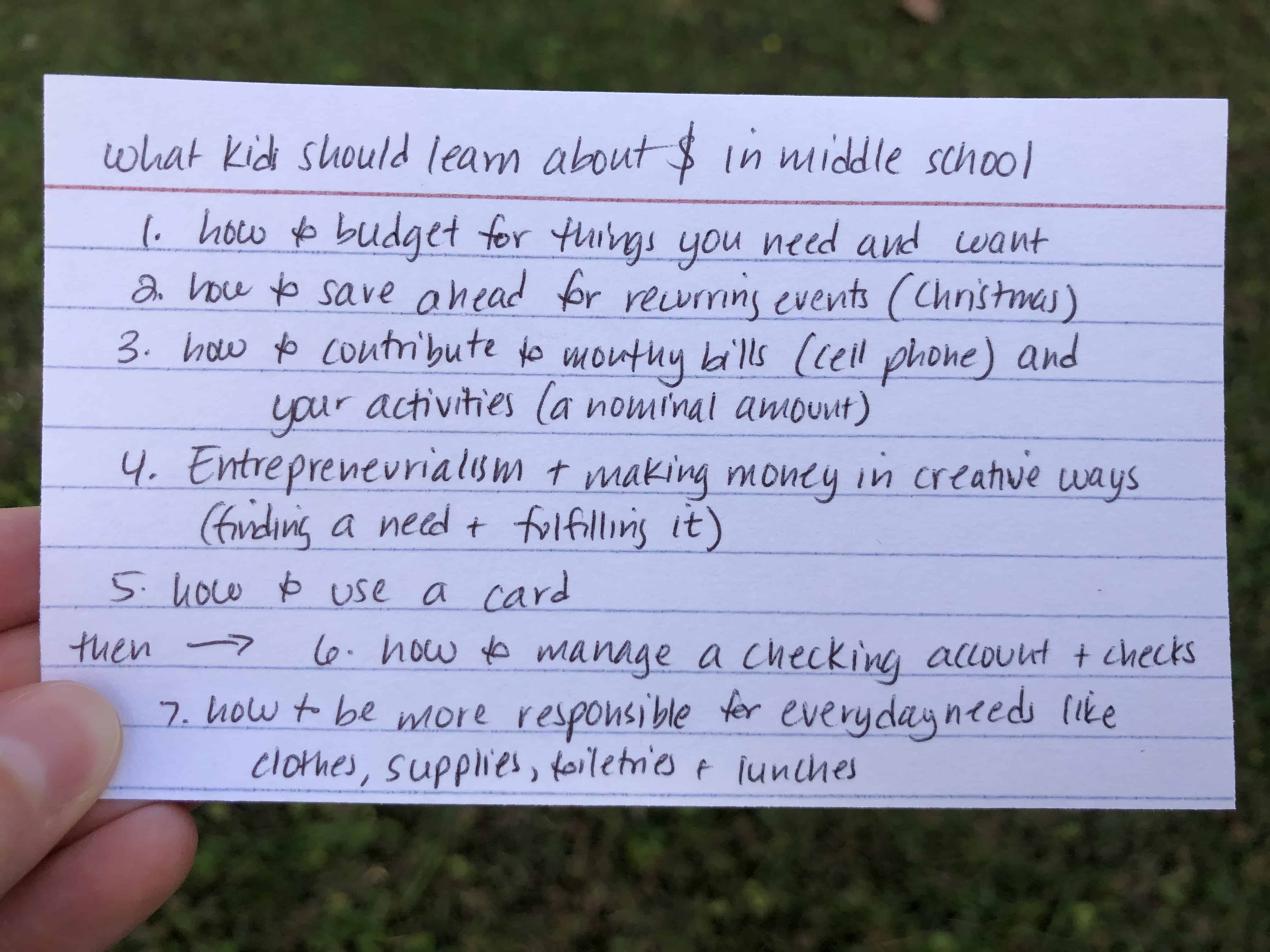

- What kids should learn about money while they’re in middle school

(I have the beginnings of a card for high school aged kids, too, but we’re not quite there yet.)

Four things I want to teach my son (the philosophical edition)

My first card was about the big picture. No specifics or to dos, just broad strokes that will hopefully lead to a good life.

- Keep it simple. Create systems and processes to manage your money easily. Think automation and paying yourself first.

- Look at the big picture and beyond today. What do you want your life to look like? Save/spend how it fits for you.

- Life is a long game (hopefully!). Small habits will lead to BIG results later. Save early, save often and keep going.

- We all have our own unique gifts and talents. What are yours? How can you use those to help others?

What kids should learn about money while they’re in elementary school

But you also need some specifics! This is the type of stuff we normally cover on the blog.

Just a note that I don’t necessarily think these should be taught IN elementary school, just that these topics are good for kids between the ages of 5 and 10.

- How to save

- How money grows with compound interest

- How to save for something you want (like a toy)

- How to keep track of how much you have (in/out)

- How to use cash

- How to give (both time and money)

- Different ways to earn money (work, savings vehicles)

- Spending basics, getting a good deal, etc

We’ve covered a lot of these topics already including saving and more saving, compound interest, saving up for a toy, keeping track, giving, savings vehicles and spending wisely.

What kids should learn about money while they’re in middle school

What’s important and relevant to an 8-year-old is different than that for a 12-year-old. Once kids get the basics (above), they can move on to more advanced topics.

Again, just a note that I don’t necessarily think that kids should learn these in middle school, rather these topics are appropriate for kids between the ages of 11 and 14!

- How to budget for things you need and want

- How to save for recurring events like Christmas

- How to contribute to monthly bills (cell phone) and your activities

- Entrepreneurialism and making money in creative ways (finding a need and fulfilling it)

- How to use a card

- How to manage a checking account and checks

- How to be more responsible for everyday needs like clothes, supplies, toiletries and lunches

We’ve covered a lot of these topics so far, too — budgeting, recurring events, contributing to activities, being an entrepreneur and how to use a card — and more will be coming as J gets older.

Your card

This was such a great activity to do — I encourage you to create a card of your own. What’s important to you that your kids learn? Share in the comments below or tag me on Twitter at @natbankofmom.

One reply on “Money advice for kids that fits on an index card”

Good lists. I think these types of concepts should absolutely be taught in school. We educate children in so many subjects and through various means to let them discover areas of interest and strength that they may pursue further. Some of those subjects and skills will be left behind as they focus on the few they wish to develop and dive into more deeply. However, everyone will need to manage finances. It is absolutely a subject and skill set that must be taught in school. Everyone will handle money in their lifetime. Everyone should be taught how financial systems and personal finance.