By this time, you already know that we subscribe to a three-envelope system (complete with registers) for savings, spending and giving. At times, we also use an additional envelope for short-term savings — when J is saving for a larger purchase a few months in advance.

The first stop in our banking process (and the reason for the name of this blog) centers around the savings envelope.

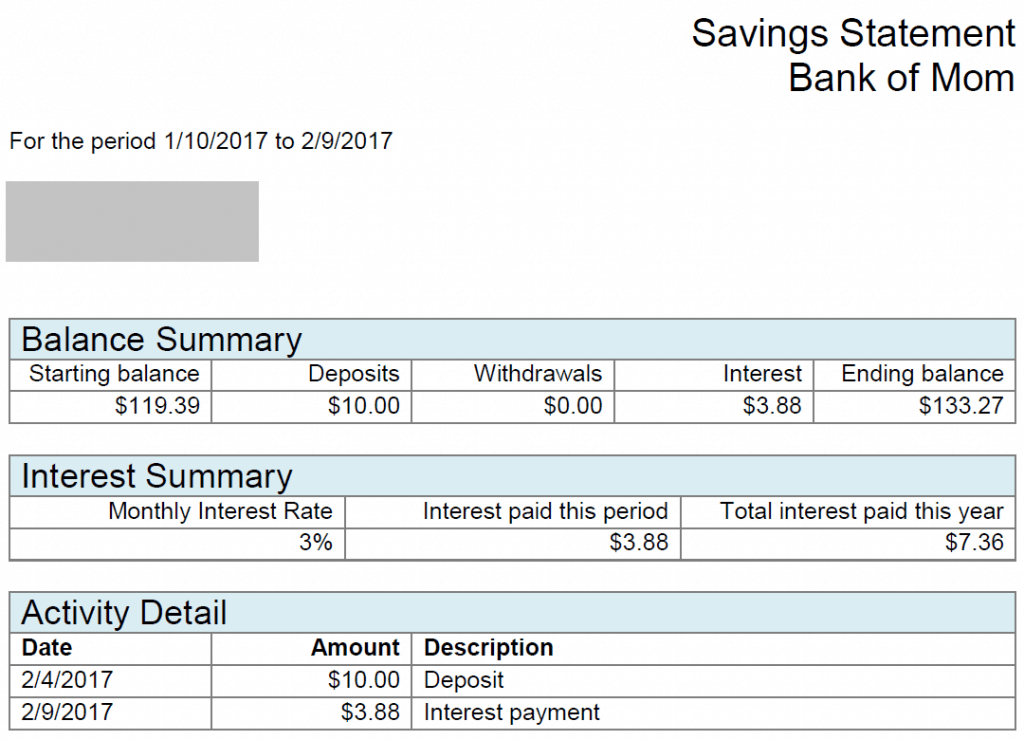

Every month on the 9th, I pay interest on the total in J’s savings envelope. To make it enough that he can see a tangible result (and earn more than the few cents he would at a bank), I pay 3% monthly.

I create a bank statement, give him a printout and also email him a copy. He writes the interest amount in his savings register to balance the account.

I developed a spreadsheet to calculate the amount and format a nice-looking statement for him. (Download a copy of the spreadsheet.) Fill in the sections in blue on the first sheet. Each month, enter the deposits made in the appropriate section, and the interest and totals will recalculate. Print a copy or save as a PDF and email away.

What is interest?

When borrowing money, interest is the money that you pay on top of what you borrow. Borrow money, pay it back AND extra.

When saving money, interest is the money that you earn. The bank “borrows” money from you and gives you a percentage of that money (for the privilege of using it). Put money in and get that amount back PLUS more.

So, why am I doing all this?

I’m a big fan of hands-on activities. I think it makes an idea infinitely easier to understand.

We’re working on the concept of compound interest — that the money you save can make more money. Deposit money (principal) and earn a percentage (interest). When you add that interest to the principal, it becomes the new principal for the next month. You then earn interest on that amount. You’re earning interest on interest!

The magic of compounding is time. The calculator site has a great calculator. Try the standard one with a principal amount of $100.00 at 6% for 25 years, compounded monthly. Check the graph of the results. For the first few years, it doesn’t feel like anything is happening. $6.12 in interest the first year — big deal. But as time goes on, notice you’re earning more and more interest each month. The last month, you earned $346.50 in interest alone! And remember, this is with contributing nothing additional! By the end, you have $446.50.

By giving J interest and a monthly statement, I’m trying to illustrate these concepts and the ones I’ve mentioned before. This gives him the opportunity to:

- Practice putting at least 10% into savings every single time he makes a deposit (he often ends up putting in much more)

- Make decisions on his own about the allocation of the rest

- See how he will continue to earn more interest each month, even if he doesn’t make any deposits (as long as he doesn’t make any withdrawals)

- And as an added bonus, we get to talk about these topics on a monthly basis

The first month, J had $43.00 and deposited $2.00 during the month. He earned $1.35 in interest. This month, 10 months later, he’s up to $119.39 and earned $3.88 in interest for a total of $133.27 (including a $10.00 deposit).

I understand that he’s still young and this might not mean very much to him now. However, if any of these seeds take root, I’m hoping he will grow into a financially healthy adult.

October 2018 Update

I’m no longer paying J in cash, calculating interest and printing paper statements. I’m still paying interest (3% monthly), but now we’re using the FamZoo system. Read more about how we made the move from cash to card earlier this summer.