In one of my very first posts, I shared a short-term savings plan for Christmas gifts. Kids can totally learn to save for Christmas gifts and purchase them by themselves. I’ve found that it makes J feel good to save the money, think of thoughtful gifts, make the purchase and wrap gifts on his own.

Because we’re using FamZoo cards now, we decided to utilize both the budget and additional account features for J’s yearly Christmas gifts list.

Create a budget

We looked over J’s past budgets (if you’re looking for a paper system, try the one we’ve used for the past two years). J determined who he wanted to buy for and how much he wanted to spend on each person. Then we entered the information into a new FamZoo budget by following these steps:

- Go to Overview, Budgets, Create Budget, choose your child as the budget owner

- Add a descriptive name (Christmas Gift List) and click Create Budget

- On the budget, add a line item for each person with their name, how much you want to spend, how many (1) and how often (1)

- The budget will be totaled at the bottom. J’s budget is $38 for 7 adults, 1 baby, 8 cats and 1 dog

Create an account

After that, we created a new spending account by following these steps:

- Go to Overview, Account Balances, Create an Account, choose your child as the account owner

- Add the account name (Christmas Gifts), choose Spending as the type of account and click Create Account

- The type of account created is an IOU account and we don’t get an actual card

- Just a note — don’t enter a starting balance. I did this and was WAY confused on what happened next. Luckily, Chris walked me through everything on the phone when I contacted support!

Chip in

I wanted to contribute an initial amount to get J started, so I added a transaction:

- Go to Overview, Account Balances, choose the Christmas Gifts account

- Enter an initial contribution (I added $5) and click Enter

- Note that NO actual money moved. Chris explained that this is how the IOU account works. I can owe J money and pay him back from anywhere — in cash, by paying for something on my credit card or transferring the money to him via our FamZoo cards

Adjust automatic allowance

Finally, I had to adjust his allowance to feed the new account.

There’s a great feature in FamZoo where you can see the weekly and monthly amounts needed to get to your budget goal for the year. For example, J’s goal of $38 breaks down to $3.17 monthly or $0.73 weekly. Unfortunately, it’s August and Christmas is in just a few months. (Next year we’re going to start in January.)

We did some quick pencil and paper math and calculated that he needed to save $33 or $11/month after my $5 contribution.

Also, I recently switched from a weekly to a monthly allowance to cut down on the number of transactions he’d have to record. So many people (my past self included) have a very difficult time with only one paycheck per month, so I’d love to get him started on this route. (Didn’t Jim Rohn say something about having too much month left at the end of the money?)

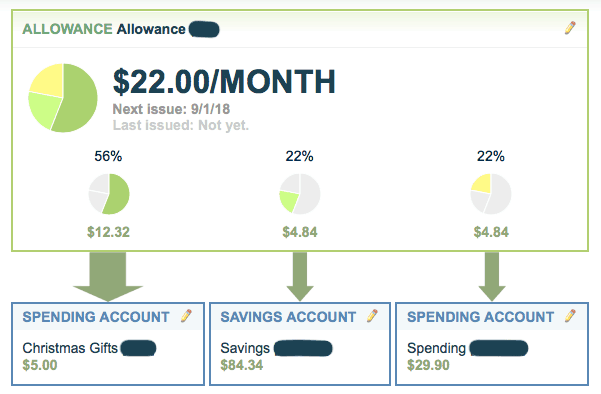

I adjusted the allowance split to direct some funds towards the Christmas Gifts account. J wanted to have a few extra dollars in case he went over budget a little, so he went with 56% or $12.32/month. He’s also still saving at least 10% of his allowance, which is my #1 requirement.

Buying gifts

Since I was already on the phone with Chris, we talked about what to do when J has saved all of his money and is ready to buy gifts.

- Go to Overview, Transfer

- Choose the Christmas Gifts IOU account as the from account and the child’s spending card as the to account

- This will move the money from MY card (remember, I’m the one who owes the IOU account) to his spending card so he can actually use it

Seems easy enough! I’ll keep you posted once we try it.

Overall, the process was a touch confusing but only because there’s always a learning curve for something new. Now that we’ve created a budget and new account, we’re experts and look forward to creating more in the future!