Do you know how much your parents made (or make)? Or how they really spend their money? I don’t.

What about your friends? Even the close ones?

I can think of just one person whose salary I know (my signifiant other), and even then, I don’t know the details of how much he’s saving or spending in various categories or what his big picture looks like.

We tell our kids not to worry about what other people are doing, so why should we be concerned with what other people make, have or spend?

For MANY of reasons, but here are two.

- Removing the mystery (and stigma) related to money can only move us forward as a society. We’re SO worried about keeping our income and expenses a secret, we’d rather talk about sex, our weight or even politics. Because we don’t talk about it, it’s hard to ask for help when we need it.

- Knowing how other people spend (and save!) can inspire you. Seeing a friend who prioritizes her family over eating out or maxes out her Roth IRA can be a powerful motivator. It’s like keeping up with the Joneses in a good way.

Because I want to open the dialog, I’m going to share my income and expenses for July and August of this year — what actually happened, what I was happy with and what I’d like to work on.

A little background before we start — I’ve been working as a freelancer for one full year now. I rent an apartment in a low cost of living area. My son lives with me half the time (shared custody and expenses); there is no child support or alimony either way. I have no debt (no mortgage, car payment or student loans).

Income

July

$2,700 + $190 from savings for dentist appointment. This was a bit low to be comfortable for me, so I increased it in August.

August

$2,900 + $300 from savings and $140.50 cash back (for a flight abroad next year).

Expenses

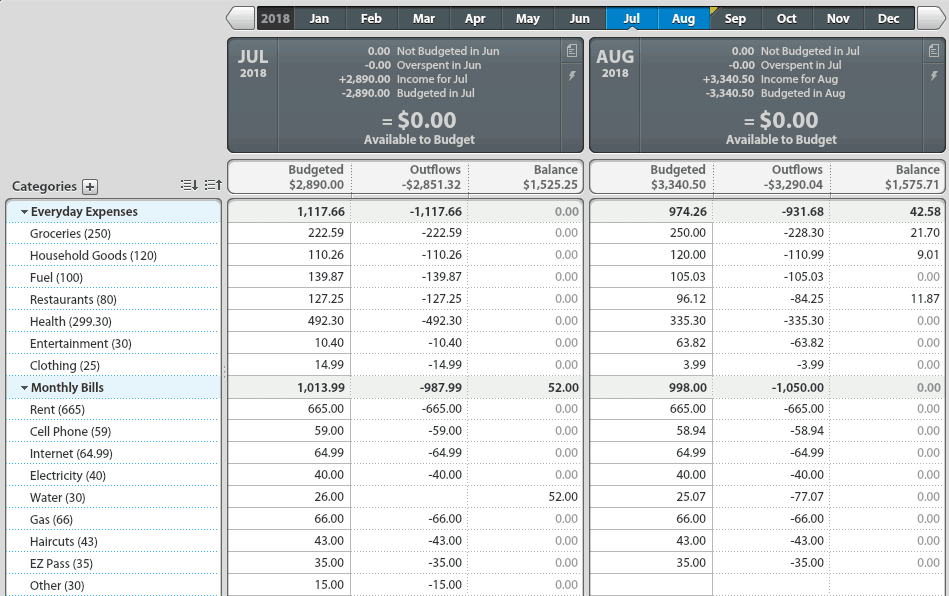

The screenshots included here are from YNAB Classic. YNAB is one of the three amazing resources that helped me get control of my finances.

In the left column are the budget categories and groupings. I have six groupings: Everyday Expenses, Monthly Bills, J, Giving, Rainy Day Funds and Savings Goals. Within each grouping, I have up to 10 individual categories. These groupings and categories make sense for me at this point in my life. Your groupings and categories will look different, and like mine, will change over time.

Next to each category I list the desired monthly budget. When I get paid on the first of the month, I use these numbers as my starting point. The best thing about the budget is that it’s just a guide. As the month progresses, I tweak these numbers — pulling from some categories and pushing to others if needed. In most categories (like groceries), I do a zero-based budget, meaning that I hardly ever leave money left over from month to month; I end up moving the excess (if there is any) elsewhere.

Here is a breakdown of every grouping and category with the desired budget, actual budget and actual amount spent for both July and August.

Everyday Expenses

Groceries (250)

Budget – July $222.59; $250 August

Spent – July $222.59; $228.30 August

Household Goods (120)

Budget – July $110.26; August $120

Spent – July $110.26; August $110.99

Fuel (100)

Budget – July $139.87; August $105.03

Spent – July $139.87; August $105.03

The price of gas seems to be going up (or I’m driving more) — I should increase the budget amount.

Restaurants (80)

Budget – July $127.25; August $96.12

Spent – July $127.25; August $84.25

I am hardly EVER on target with this as I like to eat out with friends when I can.

Health (299.30)

Budget – July $492.30; August $335.30

Spent – July $492.30; August $335.30

In July, I had to pay for a dentist visit with x-rays. In both months I was spending $36 for a gym membership (they just closed and I’m looking for another). My monthly insurance payment is $299.30 that I pay myself, out of pocket. I need to be adding more as a reserve for dentist visits and other healthcare costs.

Entertainment (30)

Budget – July $10.40; August $63.82

Spent – July $10.40; August $63.82

Clothing (25)

Budget – July $10.99; August $3.99

Spent – July $10.99 ; August $3.99

Monthly Bills

Rent (665)

Budget – July $665; August $665

Spent – July $665; August $665

Cell Phone (59)

Budget – July $59; August $58.94

Spent – July $59; August $58.94

Internet (64.99)

Budget – July $64.99; August $64.99

Spent – July $64.99; August $64.99

Electricity (40)

Budget – July $40; August $40

Spent – July $40; August $40

I’m on the budget plan for both electric and gas, so these numbers are consistent.

Water (30)

Budget – July $26; August $25.07

Spent – July $0; August $77.07

Gas (66)

Budget – July $66; August $66

Spent – July $66; August $66

Haircuts (43)

Budget – July $43; August $43

Spent – July $43; August $43

For both J and I.

EZ Pass (35)

Budget – July $35; August $35

Spent – July $35; August $35

Other (30)

Budget – July $15; August $0

Spent – July $15; August $0

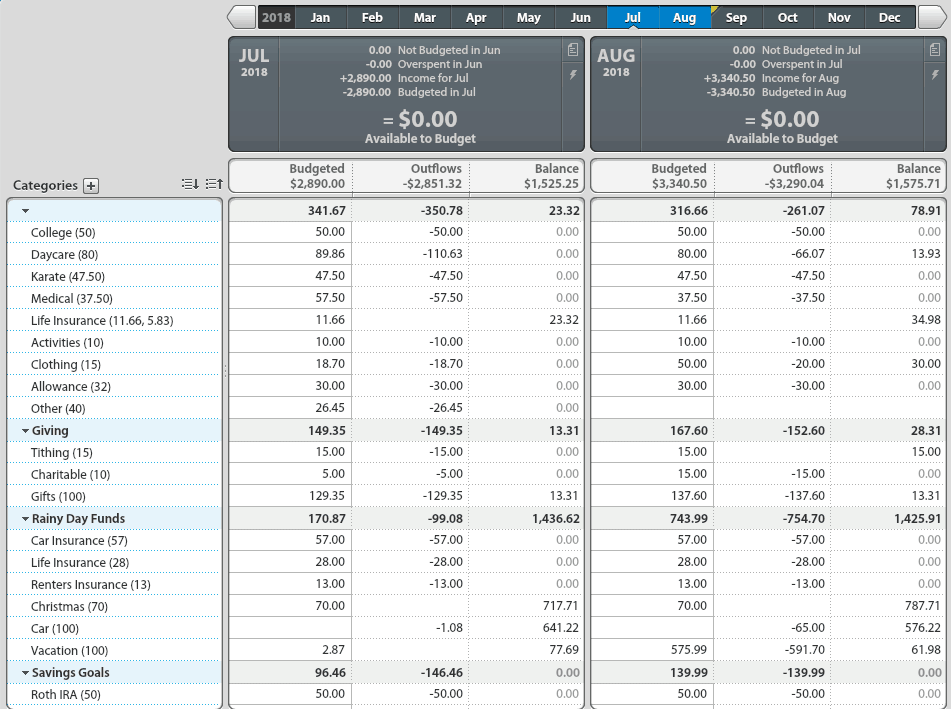

J

College (50)

Budget – July $50; August $50

Spent – July $50; August $50

I would like to contribute more to this category.

Daycare (80)

Budget – July $89.86; August $80

Spent – July $110.63; August $66.07

This includes before and after school care as well as day camp and activities in the summer.

Karate (47.50)

Budget – July $47.50; August $47.50

Spent – July $47.50; August $47.50

My half of the monthly tuition is $47.50; J’s dad pays the other half.

Medical (37.50)

Budget – July $57.50; August $37.50

Spent – July $57.50; August $37.50

My half of the monthly insurance is $37.50; J’s dad pays the other half.

Life Insurance (11.66, 5.83)

Budget – July $11.66; August $11.66

Spent – July $0; August $0

This is a small whole life policy that I opened for J when he was born.

Activities (10)

Budget – July $10; August $10

Spent – July $10; August $10

Clothing (15)

Budget – July $18.70; August $50

Spent – July $18.70; August $20

Allowance (32)

Budget – July $30; August $30

Spent – July $30; August $30

I transfer $22 for allowance and $10 for interest to our FamZoo cards.

Other (40)

Budget – July $26.45; August $0

Spent – July $26.45; August $0

Giving

Tithing (15)

Budget – July $15; August $0

Spent – July $15; August $0

Charitable (10)

Budget – July $5; August $15

Spent – July $5; August $15

I would like to increase my charitable giving budget.

Gifts (100)

Budget – July $129.35; August $137.60

Spent – July $129.35; August $137.60

Rainy Day Funds

Car Insurance (57)

Budget – July $57; August $57

Spent – July $57; August $57

It shows “spent” in the insurance categories (even though I pay them annually) because I transfer the money to a separate account each month. This is an extra step, and maybe it would be better to eliminate it for the sake of simplicity. Finances are more easily managed when they’re simple.

Life Insurance (28)

Budget – July $28; August $28

Spent – July $28; August $28

This is for a term policy and a very small whole life policy that I’ve had forever.

Renters Insurance (13)

Budget – July $13; August $13

Spent – July $13; August $13

Christmas (70)

Budget – July $70; August $70

Spent – July $0; August $0

Don’t forget kids can budget for Christmas, too.

Car (100)

Budget – July $0; August $0

Spent – July $1.08; August $65

I have not been contributing to this category like I would like to. I have some funds reserved if something breaks, but currently not enough to replace the car.

Vacation (100)

Budget – July $2.87; August $575.99

Spent – July $0; August $591.70

One of my new year’s resolutions was to book an international flight with Scott’s Cheap Flights; I paid for the flight in August.

Savings Goals

Roth IRA (50)

Budget – July $50; August $50

Spent – July $50; August $50

I am also not contributing as much as I would like to this category. Last year when I was working a full-time W2 job, I was able to max this out ($5,500 / 12 = $458.34 / month), however because I want to keep a buffer on the freelance side, I’m not paying myself as much. I am still making some contribution though. Thanks, Dad.

Not listed is my SEP IRA because the funds come from my business. This year I set up the SEP and purchased a target date retirement fund (VFIFX) with $1,200 ($100/month). As the business grows, I will contribute more.

Like anything in life, my finances are ever changing. It’s something I have to keep working on always, but I’ve found that it’s less work now that I have a great system in place. My goal is to be able to take care of myself, sleep at night and be a good role model and teacher for my son.

If you’re a blogger reading this and you have a post on your own breakdown, please comment below with the link.