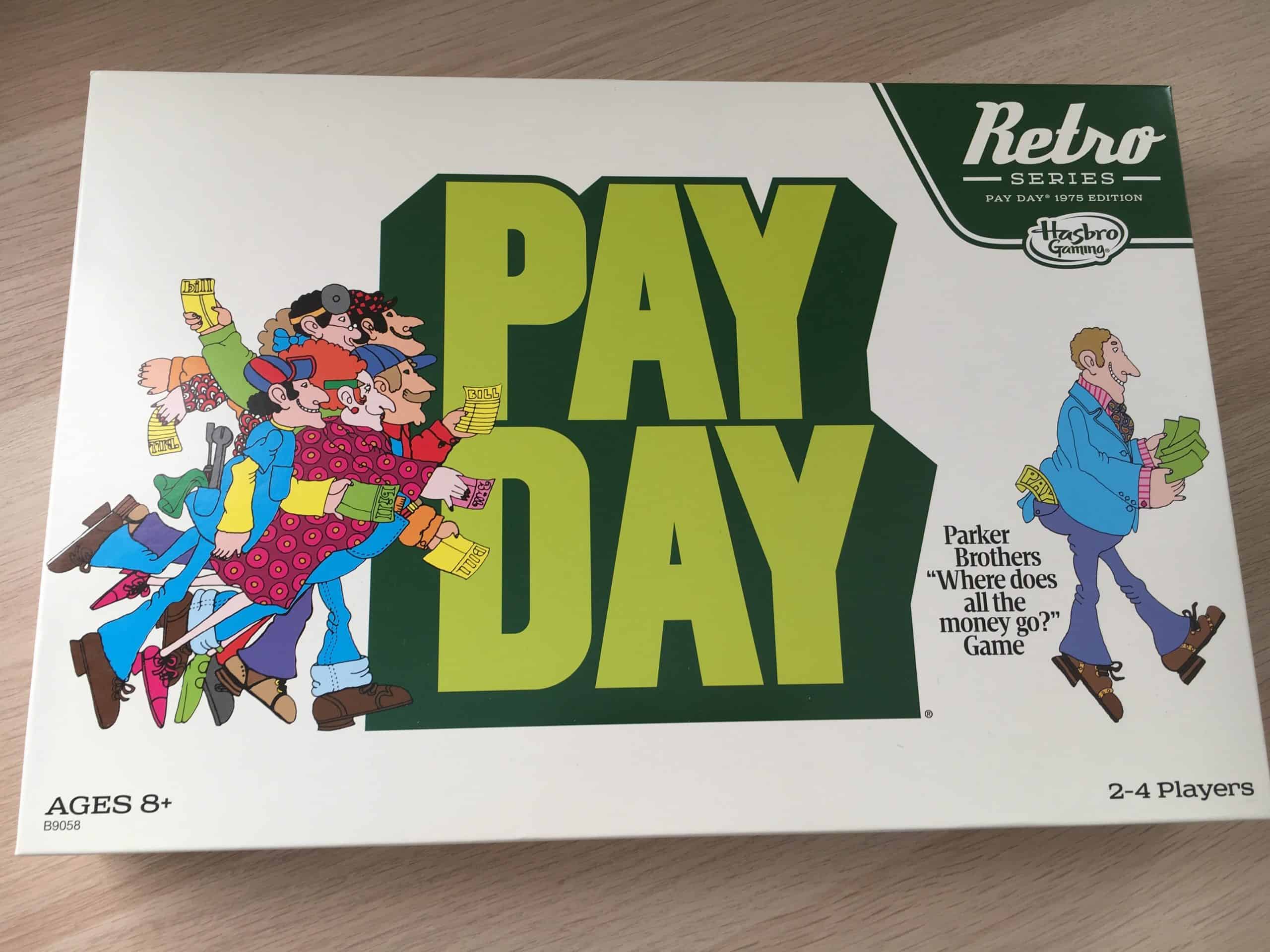

I don’t normally go out on Black Friday, but my sister and her husband came home this past Thanksgiving, so a trip to Target was in order. While shopping, I stumbled on a magical game called Pay Day.

A quick scan of the box showed that it was a money management game, and I knew I had to have it. Plus it was the “retro” edition, which made it even more desirable. (Why is that?)

I bought the game (for a discount because the Cartwheel price was lower than the in-store price) and we played our first game that weekend.

The Game

The rules are easy. Everyone starts out with $325 (in the retro edition). The board is a month, and before the game starts, you decide how many months you want to play.