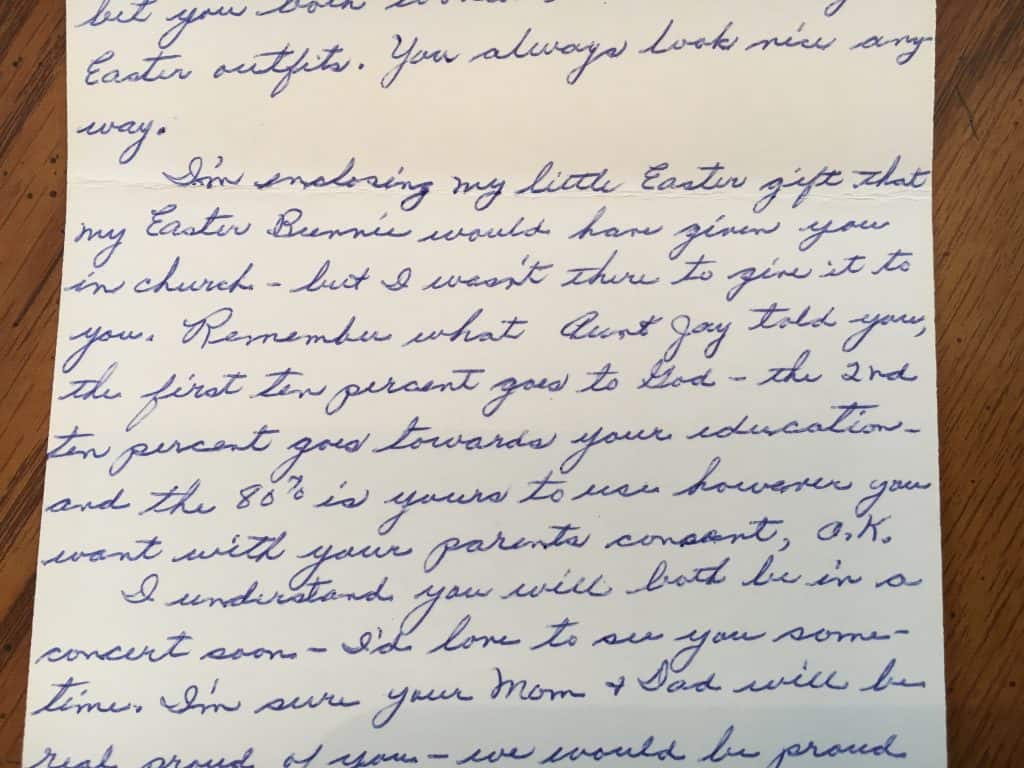

Last month we started talking about percentages in the 10-10-80 savings plan with our focus on the 10% that goes to savings. I want J to save at least 10% of all money he receives, so we’re working on how to calculate 10% of any amount.

I showed him two ways to calculate 10% last time:

- Use the 100-grid and divide the amount into 10 equal parts. $3.00 divided into 10 equal parts gives you 30 cents in each 10-block

- Move the decimal one place to the left to find 10%. $3.00 becomes $.300 or 30 cents

J got a calculator for Christmas, so we integrated it into our practice. I showed him how to find the decimal equivalent of a percentage by moving the decimal point two places to the left (10% becomes .10).